When you apply for a mortgage, lenders will generally request all three of your credit reports (one from each credit bureau) and a FICO® Score☉ based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

What Scores and Models Are Used When Applying for a Mortgage?

FICO® created different scoring models for each credit bureau—Experian, TransUnion, and Equifax. The commonly used FICO® Scores for mortgage lending are:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO® Risk Score 04

Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO® Scores. It may base the lending decision on your middle credit score or if you’re applying jointly with a partner, the lower middle score.

Keep this in mind when you’re trying to figure out what credit score you need to get a mortgage. If you’re looking for a mortgage that requires a minimum credit score of 580, you may need your middle score to be at least 580 based on these specific FICO® Score models.

There are exceptions, though. Mortgage lenders could use different credit scoring models for loans that aren’t secured or bought by Fannie Mae or Freddie Mac. You might even be able to get a mortgage if you don’t have a credit history or score at all.

Additionally, there’s a review underway that could open up the use of different credit scoring models for mortgages, even if they’re secured or bought by Fannie Mae or Freddie Mac. However, until there’s a change, many mortgage lenders will continue to use these three classic FICO® Scores.

What Else Do Mortgage Lenders Look at to Determine Mortgage Terms?

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reports—not just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns, and pay stubs. They can use these to determine your income, debts, and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment, and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Improve Your Credit Scores Before Applying, BUT you may be better off locking in on a rate before rates increase

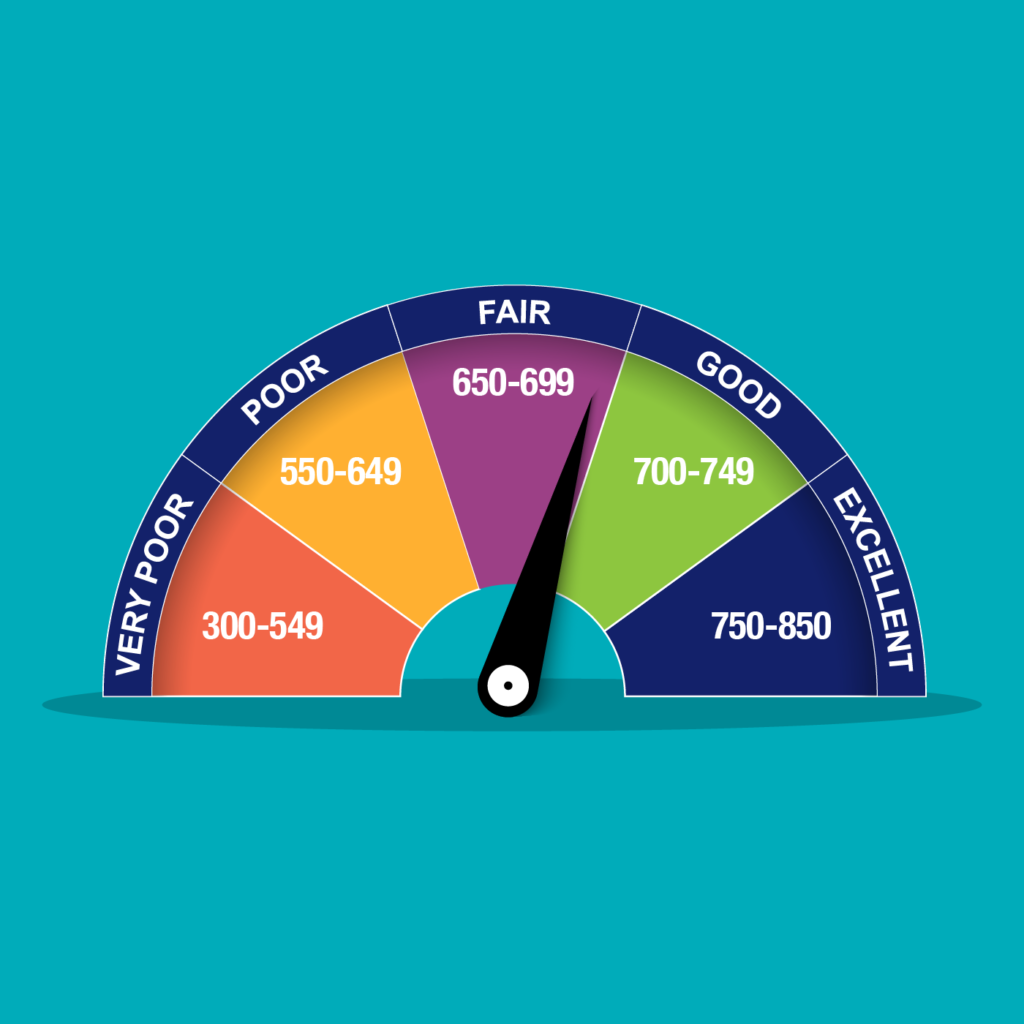

The FICO® Score versions used in mortgage lending and the more recently released versions, such as FICO® Score 9 and 10, have the same 300 to 850 range. VantageScore, a competing maker of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 model credit scores.

For all these scoring models, which use the information from one of your credit reports to determine your score, a higher score is better. As a result, you may notice similar trends in all your scores. This is why making on-time payments can help raise all your credit scores while missing payments could hurt all your scores.

However, there are also differences between the scoring models. For example, the latest FICO® and VantageScore models ignore paid collection accounts and give less weight to medical collection accounts. But the older FICO® Score models continue to count collection accounts against you after you pay off the balance.

In general, whether you’re looking to buy a home or take out a different type of credit, there are a few things that can help improve all your scores:

- Pay your bills on time.

- Pay down credit card balances.

- Don’t apply for other types of credit in the months leading up to your mortgage application.

In addition to getting your credit ready for a mortgage application, you want to get your finances in order as well. Saving up for a larger down payment, increasing your income, and paying off debts may all help you qualify for a mortgage with better terms.

Take note that if interest rates are climbing that the lesser of two evils may be locking into market rates, with a lower credit score before the FED increases interested rates. If you wait to increase your credit, ironically you may have a more unfavorable interest rate. Your loan officer can help weigh your options.

Vantage score, fico score, and credit karma

Your FICO® scores (an acronym for Fair Isaac Corp., the company behind the FICO® score) are credit scores. It’s a sort of grade based on the information contained in your credit reports. Unlike the grades you were given in school — A through F — base FICO® scores generally range from 300 to 850. And the higher, the better.

Because there are three major consumer credit bureaus (Equifax, Experian, and TransUnion), each with its own version of your credit report, you can also have different credit scores. For example, you can have a FICO® score based on your Equifax® credit report, a FICO® score based on your Experian® credit report, and a FICO® score based on your TransUnion® credit report. To further complicate things, you can also have VantageScore® credit scores (which is what Credit Kara uses) from each bureau

Additionally, FICO also creates many different credit-scoring models for lenders in different industries. So your base FICO® scores may not be the same ones a mortgage lender sees if they request your mortgage-specific FICO® scores, for example.

You probably don’t need to worry about all these nuances when buying a home, but you should still have an idea of what your scores look like. You can get your VantageScore® 3.0 credit scores (based on similar factors to your FICO® scores) from Equifax and TransUnion for free on Credit Karma.

If you want to see a soft pull of your mortgage credit scores, however, you can easily access them online from the MyFico.com website.

Also, the Fair Credit Reporting Act (FCRA) mandates that all consumers are entitled to access to a free soft pull of their credit report from the three credit bureaus TransUnion, Equifax, and Experian every 12 months at AnnualCreditReport.com. Please take note that this free credit report does not provide your mortgage credit scores.